Tax-Efficient Investing: Maximize Returns in 2025

Tax-efficient investing involves strategically managing investments to minimize tax liabilities, thereby maximizing after-tax returns, crucial for long-term financial planning and wealth accumulation in 2025.

Navigating the world of investments can be complex, but understanding how to minimize your tax burden is essential for maximizing your returns. Tax-efficient investing: Strategies to Minimize Taxes in Your Financial Plan for 2025 is crucial for building long-term wealth and securing your financial future.

Understanding Tax-Efficient Investing

Tax-efficient investing is a strategy focused on minimizing the amount of taxes paid on investment gains. This approach becomes increasingly vital as your investment portfolio grows, ensuring more of your earnings contribute to your long-term financial goals rather than going to taxes. Several factors can affect the tax efficiency of your investments, including the types of accounts used, the investment vehicles chosen, and the timing of transactions.

Key Principles of Tax-Efficient Investing

Adopting a tax-efficient investment strategy involves several key principles that can significantly impact your after-tax returns.

- Asset Location: Strategically placing assets in different account types (taxable, tax-deferred, and tax-exempt) to minimize taxes.

- Tax-Loss Harvesting: Selling losing investments to offset capital gains, reducing your overall tax liability.

- Holding Period: Understanding the difference between short-term and long-term capital gains and adjusting your investment strategy accordingly.

- Tax-Advantaged Accounts: Maximizing contributions to retirement accounts like 401(k)s and IRAs to defer or eliminate taxes.

By understanding and implementing these principles, investors can create a portfolio that reduces their tax burden and enhances their overall investment outcomes.

Utilizing Tax-Advantaged Retirement Accounts

One of the most effective ways to reduce your tax burden is by utilizing tax-advantaged retirement accounts. These accounts offer various tax benefits, from tax-deductible contributions to tax-free growth and withdrawals, depending on the account type. These accounts ensure that investments grow without the burden of annual taxes.

401(k) Plans

A 401(k) plan is a retirement savings plan sponsored by an employer. Contributions are often made on a pre-tax basis, reducing your current taxable income. The investments grow tax-deferred, meaning you don’t pay taxes until you withdraw the money in retirement.

Individual Retirement Accounts (IRAs)

IRAs come in two main flavors: Traditional and Roth. Traditional IRAs offer tax-deductible contributions, with earnings growing tax-deferred until retirement. Roth IRAs, on the other hand, don’t offer an upfront tax deduction, but qualified withdrawals in retirement are tax-free.

Contributing to these accounts not only helps you save for retirement but also provides immediate or future tax benefits, making them an essential part of a tax-efficient investment strategy.

Asset Allocation and Tax Efficiency

Strategic asset allocation plays a crucial role in tax-efficient investing. Different asset classes have varying tax implications, and allocating them appropriately can minimize your tax liability. Understanding these implications contributes significantly to tax management.

Taxable, Tax-Deferred, and Tax-Exempt Accounts

Understanding the types of accounts is critical for optimizing your investment strategy. Each account type offers different tax advantages.

- Taxable Accounts: These accounts are subject to taxes on dividends, interest, and capital gains each year.

- Tax-Deferred Accounts: These accounts, like traditional 401(k)s and IRAs, allow your investments to grow without being taxed until withdrawal.

- Tax-Exempt Accounts: Roth IRAs and Roth 401(k)s offer tax-free growth and withdrawals, provided certain conditions are met.

Allocating asset classes based on their tax efficiency is crucial for maximizing after-tax returns and minimizes your overall tax liability.

Tax-Loss Harvesting Strategies

Tax-loss harvesting is a strategy that involves selling investments at a loss to offset capital gains, thereby reducing your tax liability. This approach is particularly useful in taxable accounts where capital gains are taxed.

How Tax-Loss Harvesting Works

Tax-loss harvesting involves carefully monitoring your investment portfolio for assets that have declined in value. When you sell these losing assets, you can use the losses to offset any capital gains you’ve realized during the year.

Wash-Sale Rule

The IRS has a rule called the “wash-sale rule,” which prevents you from immediately repurchasing the same or a substantially similar investment within 30 days before or after the sale. If you violate this rule, you won’t be able to claim the loss for tax purposes.

By strategically implementing tax-loss harvesting while adhering to the wash-sale rule, investors can reduce their tax burden and potentially improve after-tax investment returns.

Managing Capital Gains and Dividends

Capital gains and dividends are two common sources of investment income that are subject to taxes. Understanding how these are taxed and implementing strategies to manage them can significantly impact your overall tax efficiency and plays a significant role in investment outcomes.

Capital Gains

Capital gains are profits earned from selling an asset for more than you paid for it. Short-term capital gains (assets held for one year or less) are taxed at your ordinary income tax rate, while long-term capital gains (assets held for more than one year) are taxed at lower rates.

Qualified Dividends

Qualified dividends, which are dividends that meet certain IRS requirements, are taxed at the same lower rates as long-term capital gains. Understanding the distinction between qualified and non-qualified dividends is key to managing your tax liability.

Managing these components of investment income effectively could boost your investments.

Planning for 2025: Staying Ahead of Tax Law Changes

Tax laws are subject to change, so it’s essential to stay informed and adapt your investment strategy accordingly. The ever-shifting landscape means investors and advisors must remain aware of the evolving laws.

Potential Tax Law Changes in 2025

As we approach 2025, there are several potential tax law changes that could impact your investment strategy. Some key areas to watch include changes to capital gains tax rates, adjustments to retirement account contribution limits, and modifications to estate tax laws.

Seeking Professional Advice

Given the complexities of tax laws and investment strategies, seeking professional advice from a financial advisor or tax professional can be invaluable. These experts can help you develop a personalized tax-efficient investment plan tailored to your specific financial goals and circumstances.

Staying informed about potential tax law changes and seeking expert advice will enable you to proactively manage your investments and minimize your tax burden in 2025 and beyond.

| Key Point | Brief Description |

|---|---|

| 💰 Tax-Advantaged Accounts | Utilize 401(k)s and IRAs to defer or eliminate taxes on investment gains. |

| 📉 Tax-Loss Harvesting | Offset capital gains by selling losing investments. Watch out for the wash-sale rule! |

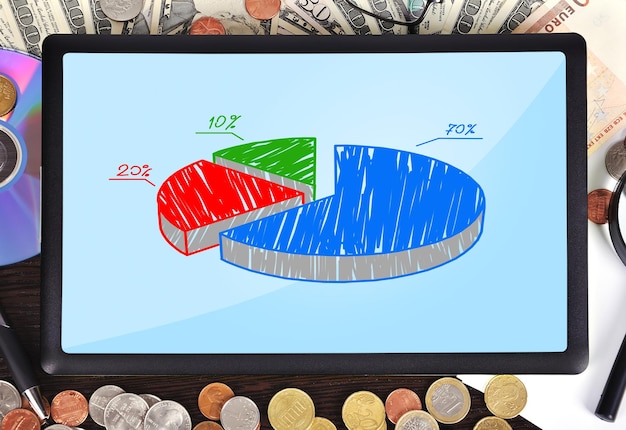

| 📊 Asset Allocation | Strategically place assets in taxable, tax-deferred, and tax-exempt accounts to reduce tax liability. |

| 📅 Stay Informed | Keep abreast of tax law changes to adjust your strategy effectively for 2025 and beyond. |

Frequently Asked Questions

▼

Tax-efficient investing involves strategies to minimize the amount of taxes paid on investment income and gains, ultimately increasing your after-tax returns and helping you grow your wealth faster.

▼

Tax-advantaged accounts like 401(k)s and IRAs offer benefits either through tax-deductible contributions or tax-free growth and withdrawals, helping to reduce your overall tax burden while saving for retirement.

▼

Tax-loss harvesting is the practice of selling investments at a loss to offset capital gains, reducing your tax liability. This strategy can be particularly useful in taxable investment accounts.

▼

Strategic asset allocation across taxable, tax-deferred, and tax-exempt accounts can optimize tax efficiency by placing high-turnover, taxable assets in tax-advantaged accounts and lower-turnover assets in taxable accounts.

▼

Tax laws are subject to change, so staying informed and planning for potential changes in tax laws, such as those expected in 2025, is crucial to optimizing your tax-efficient investment strategy.

Conclusion

Implementing tax-efficient investing: Strategies to Minimize Taxes in Your Financial Plan for 2025 is a vital component of sound financial planning. By understanding and utilizing tax-advantaged accounts, employing tax-loss harvesting techniques, strategically allocating assets, and staying informed about upcoming tax law changes, you can significantly reduce your tax burden and maximize your investment returns, ultimately securing a more prosperous financial future. As the landscape of finance evolves, the ability to adapt and refine these strategies will prove invaluable.