Best Personal Finance Apps: Budgeting, Investing & Net Worth Tracking

Personal Finance Apps: Compare the Best Tools for Budgeting, Investing, and Tracking Your Net Worth: Discover the top personal finance apps that can empower you to take control of your money, offering features for budgeting, investment tracking, and monitoring your overall financial health, all in one place.

Taking control of your finances can feel overwhelming, but with the right tools, it becomes much more manageable. Today, we’re exploring the best Personal Finance Apps: Compare the Best Tools for Budgeting, Investing, and Tracking Your Net Worth which help you budget, invest, and monitor your financial health effortlessly.

Why Use Personal Finance Apps?

Personal finance apps can revolutionize how you manage your money. They bring together all your financial information in one place, providing a clear and comprehensive view of your financial status.

These apps offer a multitude of benefits that can significantly improve your financial habits. Let’s examine some key reasons for embracing personal finance apps:

Centralized Financial Overview

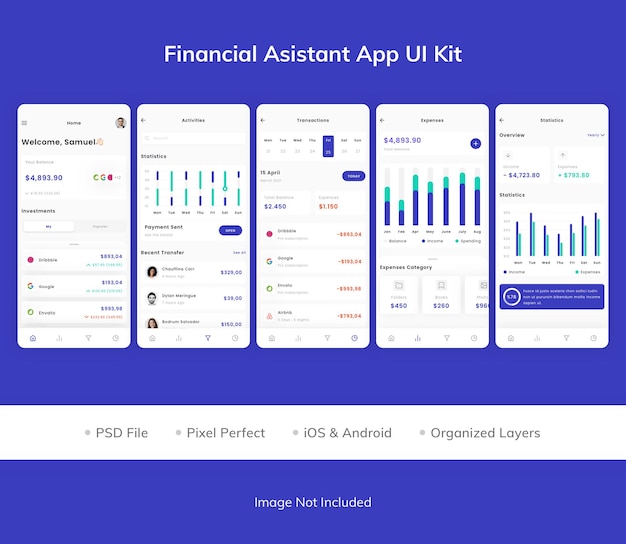

One of the primary advantages of using personal finance apps is the ability to consolidate all your financial accounts—checking, savings, credit cards, and investments—into a single dashboard. This holistic view allows you to monitor your cash flow and net worth at a glance.

Automated Budgeting

Many apps come equipped with powerful budgeting tools that automate the process of tracking expenses and categorizing transactions. By setting budget limits and receiving notifications when you’re close to exceeding them, you can stay on top of your spending habits.

- Expense Tracking: Automatically categorize and track your spending for better insights.

- Budget Setting: Create and manage budgets aligned with your financial goals.

- Alerts and Notifications: Receive real-time alerts to avoid overspending.

By providing a centralized financial overview and automated budgeting tools, these apps simplify money management, helping you save time and make informed decisions.

Key Features to Look for in Personal Finance Apps

Selecting the right financial app involves identifying your specific needs and understanding the features that cater to those needs. Here’s what to consider when comparing personal finance apps.

The features offered by personal finance apps can greatly influence your overall financial management. To help you choose the best tool, focus on these critical elements:

Budgeting Tools

Effective budgeting tools are crucial for managing your spending and saving habits. Look for apps that allow you to create custom budgets, track expenses, and provide real-time insights into your spending patterns.

Investment Tracking

If you have investments, it’s essential to monitor their performance and manage your portfolio. Apps that offer investment tracking features provide real-time updates, performance analysis, and tools for diversification.

- Portfolio Management: Track and manage your investments in one place.

- Performance Analytics: Analyze your investment returns and identify areas for improvement.

- Asset Allocation: Optimize your asset allocation to maximize returns and minimize risk.

Considering these features will help you select a personal finance app that aligns with your unique financial goals and enhances your ability to manage money effectively.

Top Apps for Budgeting

Budgeting-focused apps are designed to help you gain control over your income and expenses. They offer tools for setting budgets, tracking spending, and visualizing your financial health.

Budgeting apps are indispensable for understanding where your money goes and implementing effective strategies to save more. Here are some leading options:

Mint

Mint is a popular free app that consolidates all your financial accounts into one dashboard. It offers budgeting tools, bill payment reminders, and credit score monitoring.

YNAB (You Need A Budget)

YNAB is a paid app that focuses on conscious spending. It encourages users to allocate every dollar to a specific purpose, promoting financial discipline and awareness.

- Envelope Budgeting: Allocate funds to various spending categories.

- Goal Setting: Create and track progress towards financial goals.

- Debt Management: Develop strategies to pay off debt efficiently.

Choosing the right budgeting app can transform your financial habits, helping you save more effectively and achieve your financial goals faster.

Best Apps for Investment Tracking

Investment tracking apps provide the tools needed to monitor and manage your investment portfolio. These apps offer real-time data, performance analytics, and insights into your investments.

For investors, having a reliable investment tracking app is essential to staying informed and making strategic decisions. Consider these top choices:

Personal Capital

Personal Capital offers a comprehensive view of your financial life, including investment tracking, net worth calculations, and retirement planning tools. It stands out with its sophisticated analytics.

SigFig

SigFig provides automated investment management, portfolio tracking, and financial advice. It’s ideal for both beginners and experienced investors looking for hassle-free solutions.

By using these investment tracking apps, you can stay informed, manage your portfolio effectively, and make data-driven decisions to optimize your investment returns.

Apps for Tracking Your Net Worth

Tracking your net worth is a crucial part of understanding your overall financial health. These apps collect data from your assets and liabilities to provide a comprehensive view of your financial position.

Monitoring your net worth allows you to see the big picture of your finances and track progress towards your long-term financial goals. Here are a few recommended apps:

Empower (Formerly Personal Capital)

Empower, previously known as Personal Capital, provides net worth tracking alongside investment and budgeting tools. It allows you to see how your assets and liabilities change over time.

Intuit Mint

Beyond budgeting, Mint also offers net worth tracking by linking all your financial accounts. It provides a simple way to monitor your financial progress in one place.

- Comprehensive Financial Overview: See all your assets and liabilities in one place.

- Trend Analysis: Track your net worth over time to monitor progress.

- Goal Setting: Set and track financial goals, such as retirement or homeownership.

With these apps, you can gain a clearer understanding of your financial health and make informed decisions to grow your net worth.

Security and Privacy Considerations

When using personal finance apps, it’s vital to consider the security and privacy of your financial data. Choose apps that prioritize data encryption, multi-factor authentication, and secure data storage.

Protecting your financial information is paramount. Here are essential security and privacy considerations to keep in mind:

Data Encryption

Ensure that the app uses robust data encryption to protect your financial information during transmission and storage. Encryption helps prevent unauthorized access.

Multi-Factor Authentication

Opt for apps that offer multi-factor authentication (MFA) to add an extra layer of security. MFA requires you to verify your identity using multiple methods, such as a password and a verification code sent to your mobile device.

By carefully considering these security and privacy factors, you can protect your financial information and use personal finance apps with confidence.

| Key Point | Brief Description |

|---|---|

| 💰 Budgeting Tools | Helps manage income and expenses effectively. |

| 📈 Investment Tracking | Monitors and manages investment portfolios. |

| 📊 Net Worth Tracking | Provides a comprehensive view of financial position. |

| 🔒 Security | Ensures data encryption and multi-factor authentication. |

FAQ

A personal finance app is a software application designed to help users manage their finances, track spending, create budgets, and monitor investments all in one place.

These apps connect to your bank and credit card accounts to automatically import transactions, categorizing them for expense tracking and reporting.

Most apps use encryption and secure connections to protect your data, but it’s crucial to choose apps with strong security measures and multi-factor authentication.

Yes, many personal finance apps offer features for tracking investment portfolios, analyzing performance, and setting financial goals related to investments.

Many apps offer basic features for free, while premium features like advanced analytics or personalized advice may require a subscription fee.

Conclusion

Choosing the right personal finance app can significantly impact your ability to manage and grow your money. By considering your specific needs and the features offered by different apps, you can find a tool that helps you achieve your financial goals effectively. Whether it’s budgeting, investment tracking, or net worth monitoring, there’s an app out there to support your financial journey.